Real Estate as a Low-risk and Long-term Investment

Real estate is a commonly favored investment among people, thanks to its ability to yield long-term growth and consistent passive income through rent payments. Nevertheless, as with any investment, it's crucial to thoroughly assess the potential risks involved.

In this article, we will explore the reasons for investing in real estate, the profitability, the risks associated with investing in real estate, and various ways to invest in this asset.

Why Invest in Real Estate?

There are several compelling reasons why investing in real estate can be a smart financial move.

Real estate has a proven track record of stability and growth, offering a reliable source of passive income through rent payments. These features make it an appealing choice for investors seeking to diversify their investments and reduce their exposure to risk.

Additionally, real estate investments can serve as a hedge against inflation and market fluctuations, providing a safe and reliable store of value.

Finally, real estate can offer significant potential for capital gains. Specifically, resort regions around the world have seen an increase in demand for housing, leading to rising prices.

Real Estate Profitability

When comparing real estate to other investment options, it is worth noting that, despite potentially lower yields (with average annual returns of about 4% for funds and companies, or 5% for direct investments), real estate performance is on par with numerous equities. This comparison underscores the dependable and steady nature of real estate investments, which are often characterized by diminished volatility.

For example, during 2021 and 2022, the real returns on 10-year US Treasury bonds ranged between 1.3% and 1.7%, significantly lower than the customary returns in the US real estate market. Amidst considerable fluctuations in the stock market at the time, real estate proved to be a more stable and appealing alternative for investors in search of a risk-reward equilibrium.

Risks of Investing in Real Estate

Although real estate investments generally exhibit lower vulnerability to economic risks, it is crucial to recognize that the market can still undergo growth, decline, and even turmoil cycles. Despite these fluctuations, the need for housing remains relatively stable, as people consistently require shelter, ensuring a steady flow of rental income for property owners.

Nonetheless, real estate investments carry inherent physical risks. Properties can be subject to damage from natural disasters, accidents, or gradual deterioration. For instance, a house may be devastated by a fire, leading to expensive repairs, necessitating reconstruction, or total loss of an asset. Consequently, investors must be mindful of these physical risks and take suitable precautions, such as securing comprehensive insurance coverage, to protect their investments and minimize potential losses.

How to Invest in Real Estate?

There are various options for investing in real estate, each presenting its own set of benefits and challenges. In this section, we will discuss three prevalent methods of real estate investment, supported by figures, examples, and relevant data.

Purchase real estate in its entirety

One popular method of investing in real estate involves purchasing a property in its entirety, resulting in complete ownership of a residential or commercial asset. This approach allows investors to exercise full control over their investment, disposing of the property as they see fit to maximize returns.

However, acquiring a property in its entirety has its drawbacks. Firstly, this investment strategy necessitates a significant upfront capital commitment, which may be a barrier for some investors. Secondly, concentrating a large sum of money into a single property can lead to poor diversification, increasing the risk associated with the investment.

Purchase a share in real estate

Investors can also consider fractional ownership or co-investment in real estate. This strategy entails multiple investors pooling their resources to buy a property, with each investor owning a proportionate share of the asset. Fractional ownership allows investors with limited capital to engage in the real estate market and benefit from property appreciation and rental income.

Invest in real estate funds or companies that own real estate

Another alternative is to invest in real estate investment trusts (REITs), mutual funds, or companies that own or manage real estate assets. This method provides exposure to the real estate market without the need for direct property management.

Each of these strategies presents a distinct path for real estate investment, allowing investors to choose the approach that best suits their financial objectives, risk appetite, and desired level of involvement in property management.

Conclusion

Real estate investment can be a valuable avenue for individuals seeking to establish long-term financial stability and create a passive income stream. Nonetheless, weighing the potential risks, including market fluctuations and unforeseen costs, is crucial. Through diligent research and strategic investment selection, such as purchasing property outright, buying a share in a property, or investing in real estate funds or companies, investors can reduce their risk exposure while maximizing their potential returns.

► Sabai Academy — a place where studying blockchain, crypto, fractional ownership, and real estate investments becomes a catalyst for capital growth!

Sabai Academy

BOOST your knowledge with our FREE crypto courses!

Related Articles

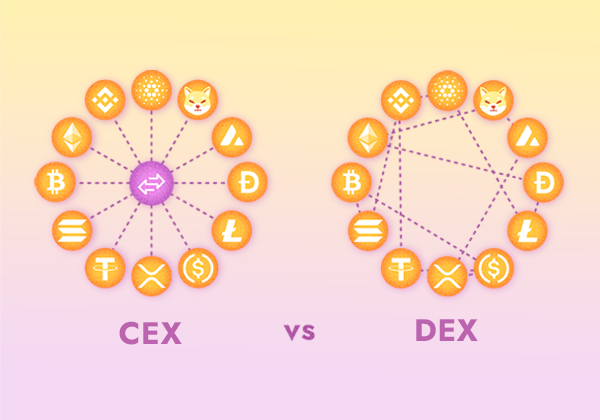

CEX and DEX: How Do Cryptocurrency Exchanges Differ?

What is Token Burning, and How Does It Work?