What is Double Spending?

In the cryptocurrency landscape, a phenomenon known as double spending arises when a digital currency unit is expended more than once. This phenomenon could challenge the credibility of cryptocurrency transactions. This article endeavors to elucidate the concept of double spending, examine its ramifications, and detail preventive methodologies currently employed.

Table of contents

Detailed Explanation of Double Spending

Double spending poses a significant concern within the digital monetary system, wherein identical funds may be spent twice. This issue, in the absence of appropriate preventive measures, renders any protocol susceptible to exploitation; it leaves users uncertain about the security of their funds, unsure if their digital currency has been expended elsewhere.

In the realm of cryptocurrencies, restricting the duplication of specific coins is crucial to maintain the stability and integrity of the system. For instance, if Bob were to receive 200 units of a certain cryptocurrency and could simply duplicate them ten times to obtain 2000 units, the overall value of the currency could depreciate significantly, leading to systemic collapse. Likewise, the system could falter if the same 200 units were simultaneously transmitted to two recipients, such as Max and Sofia.

Thus, the proper functioning of digital currencies necessitates the development and implementation of mechanisms that curb these possibilities. These mechanisms must robustly detect and prevent double-spending attempts, ensuring the singularity of transactions. This not only preserves the integrity of the systems, but also bolsters user trust and engagement in the long run.

Solutions to Prevent Double Spending

In this section, we will delve into the solutions designed to combat the issue of double spending.

Centralized Solution

Implementing a centralized system is generally simpler than its decentralized counterparts. In essence, it involves a single entity or institution maintaining control over the system, managing the issuance and allocation of new units. An effective example of a centralized solution to the double-spending problem is the digital currency system proposed by Stefan Brands.

To provide users with a digital asset akin to cash (allowing anonymous and peer-to-peer transactions), a financial institution could employ blind signatures, as illustrated in Brands' seminal 1993 paper "Untraceable Off-line Cash in Wallets with Observers."

For instance, consider a user, whom we'll refer to as Robert, desiring $50 in digital currency. Initially, he would notify the bank of this requirement. If his account holds sufficient balance, it would generate one or multiple random numbers for smaller denominations. Let's assume it generates ten numbers, each assigned a value of $5. To prevent the bank from tracing these monetary units, Robert obscures these random numbers by introducing a blinding factor.

He then forwards the data to the bank, which deducts $50 from his account and signs messages validating that each of the ten information pieces corresponds to $5. Robert is now capable of spending the funds issued by the bank. He goes to a café owned by Julia and purchases a meal costing $20.

Robert can remove the blinding factor to utilize a random number associated with the digital currency as a unique identifier (akin to a serial number) in the check. He discloses four of these to Julia, who must promptly verify them at the bank to ensure Robert cannot expend the same funds elsewhere. The bank checks the signatures and, if accurate, credits Julia's account with $20.

Upon verification, the utilized checks are voided. If Julia wishes to use her new balance, she would need to procure new checks similarly.

Although Brands' digital currency system may facilitate private transactions, it also has its shortcomings. The bank remains a potential point of failure. The issued check holds no intrinsic value as its worth is solely determined by the bank's readiness to exchange it for currency. Consequently, customers are left dependent on the bank to utilize their money - a predicament that cryptocurrencies aim to alleviate.

Decentralized Solution

Maintaining a double-spending-free ecosystem without a centralized authority poses a formidable challenge. In such a scenario, participants would need to reach a consensus on rules to deter fraud and promote honesty.

Bitcoin's whitepaper introduced a revolutionary solution to double spending, utilizing a data structure now known as the blockchain. This database possesses unique characteristics, with network participants (or nodes) using specialized software to synchronize their copy of the database with the rest of the network. This transparent record of transactions from the genesis block enables easy detection and prevention of fraudulent activities like double spending.

Transactions broadcasted by a user are not instantly added to the blockchain. They must first be included in a block through a process known as mining. The recipient should only consider the transfer valid once the transaction-containing block is added to the blockchain. Failure to do so might result in non-receipt of funds if the sender reallocates the same coins elsewhere.

Once a transaction is confirmed, the coins can't be double spent as the ownership is transferred and verifiable by the entire network. This is why it is recommended to wait for multiple confirmations before accepting a payment. Each subsequent block increases the difficulty of altering or rewriting the chain (as seen in a 51% attack).

Let's illustrate this with an example. Joe decides to pay for his meal at a restaurant in Bitcoin. He orders his meal, costing 0.005 BTC, and broadcasts the transaction to the restaurant's public address.

As soon as Joe broadcasts this transaction, anyone can verify his ownership of the coins, thus validating his right to transfer them. However, for the transaction to be considered valid, it must be included in a confirmed block. Therefore, the restaurant should wait for confirmation before accepting Joe's payment. This process safeguards against the possibility of Joe double spending the same amount elsewhere, ensuring the transaction's legitimacy.

Conclusion

Crypto double spending poses a significant challenge in the digital financial ecosystem by enabling the same digital assets to be expended more than once for profit. This problem has stifled progression in the field due to the need for more satisfactory solutions.

However, implementing blind signatures has provided a remedy for many issues endemic to centralized financial systems. Additionally, the inception of the Proof-of-Work algorithm and blockchain technology has paved the way for Bitcoin, a robust form of decentralized currency. This groundbreaking development has inspired the launch of thousands of other cryptocurrency initiatives.

► Sabai Academy — a place where studying blockchain, crypto, fractional ownership, and real estate investments becomes a catalyst for capital growth!

Sabai Academy

Smart Reward System exclusive for academy participants!

Related Articles

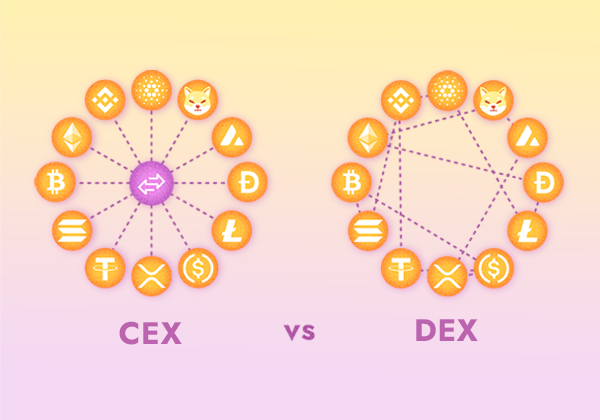

CEX and DEX: How Do Cryptocurrency Exchanges Differ?