What is KYC, and Why is It Needed?

As the world of cryptocurrency continues to expand, ensuring security, trust, and compliance becomes increasingly crucial. One integral aspect of achieving these goals is KYC, or Know Your Customer.

In this article, we will uncover why KYC is a vital requirement in the cryptocurrency industry, addressing the challenges it addresses and the benefits it brings.

Table of contents

What is KYC?

KYC, or Know Your Customer, is a crucial process employed in the realm of cryptocurrencies to verify the identities of individuals engaging in financial transactions. It serves as a means to combat fraudulent activities, money laundering, and terrorist financing. By implementing crypto KYC measures, cryptocurrency platforms and service providers seek to establish trust, ensure compliance with regulations, and create a safer environment for users.

The KYC in crypto typically involves collecting and verifying personal information from customers. This information may include government-issued identification documents (such as passports or driver's licenses), proof of address, and in some cases, additional details like employment information or financial statements. By obtaining this information, cryptocurrency platforms can confirm the identity of their customers and assess potential risks associated with their transactions.

For instance, when a user registers on a cryptocurrency exchange, they are often required to provide personal information and submit relevant documents. The exchange then verifies the authenticity of the provided information by conducting various checks. Once the crypto KYC process is successfully completed, users are granted access to the platform's services, including depositing funds, trading cryptocurrencies, and withdrawing funds.

Why is KYC Needed in Cryptocurrency?

Know Your Customer (KYC) principles play a critical role in the cryptocurrency sector due to several compelling factors.

Firstly, they provide a robust defense against illegal activities such as money laundering and terrorist financing. By ensuring that every individual participating in a transaction can be identified and their financial activities tracked, cryptocurrencies can shed their notorious association with illicit deeds.

Secondly, KYC verification is a regulatory requirement in many jurisdictions. Entities operating in the cryptocurrency space, such as exchanges and wallet providers, are increasingly being required to comply with KYC procedures to ensure transparency and legal compliance. This strengthens the legitimacy of the cryptocurrency sector and fosters trust among its stakeholders, including users, regulators, and potential investors.

Thirdly, implementing KYC procedures can help mitigate fraud risks. In an industry that is notoriously prone to scams, and phishing attempts, a stringent KYC crypto process can ensure that only legitimate users participate in transactions, which significantly reduces the risk. Moreover, KYC principles contribute to the creation of a safer and more secure cryptocurrency environment by promoting traceability and accountability.

Lastly, KYC protocols contribute to the development of a healthier and more sustainable cryptocurrency market. They foster trust among market participants, attract institutional investors, and increase overall market stability. This makes cryptocurrencies more appealing to a broader user base, encouraging market growth and potentially leading to increased mainstream adoption.

Advantages of KYC

KYC (Know Your Customer) implementation in the cryptocurrency industry offers several distinct advantages:

- Risk Management: KYC practices enable businesses to effectively manage and mitigate risk. By knowing their customers, businesses can more accurately assess potential risks that certain customers might pose, be it credit risk or reputational risk.

- Improved Customer Relationships: KYC practices often involve a detailed understanding of customers’ transaction behaviors, which can aid in personalized customer service. This can enhance customer satisfaction and loyalty, leading to better business-client relationships.

- Prevention of Identity Theft: KYC procedures can be instrumental in preventing identity theft. As customers are required to provide valid identification documents and sometimes biometric data, it becomes harder for fraudsters to impersonate them.

- Operational Efficiency: Through the use of automated KYC verification systems, businesses can improve their operational efficiency by reducing the time and resources spent on customer due diligence.

- Business Reputation: Rigorous KYC procedures can enhance a business’s reputation by demonstrating its commitment to comply with international regulatory standards and its dedication to maintaining a safe and secure business environment.

- Access to Global Markets: Implementing strong KYC procedures can open doors to global markets, especially countries that place a strong emphasis on compliance with international anti-money laundering and counter-terrorism financing regulations.

- Better understanding of Customer Behavior: KYC can provide valuable insights into customers' behavior, needs, and preferences, which can be used to tailor products and services accordingly.

Disadvantages of KYC

Despite its advantages, the implementation of KYC (Know Your Customer) measures in the cryptocurrency industry also presents certain disadvantages that need to be considered.

One significant drawback is the potential compromise of user privacy. KYC in crypto requires individuals to provide personal information, including sensitive identification documents and financial details. This raises concerns about the security and potential misuse of such sensitive data. Even with measures in place to protect user information, the risk of data breaches or unauthorized access remains, posing privacy risks for individuals.

Another disadvantage is the potential barrier to entry and reduced accessibility. The comprehensive KYC process may be perceived as burdensome and inconvenient by some users, deterring their participation in cryptocurrency transactions.

Furthermore, KYC implementation adds additional costs and administrative burdens for cryptocurrency platforms. Establishing and maintaining robust KYC procedures require significant resources, including personnel, technology, and compliance measures. These costs can be passed on to users in the form of higher fees or restrictions, potentially limiting affordability and accessibility for certain individuals.

Lastly, the implementation of KYC in blockchain measures may contradict the fundamental principles of decentralization and anonymity associated with cryptocurrencies.

Conclusion

Through the process of verifying customer identities, KYC helps establish trust, enhance security, and ensure regulatory compliance within the crypto industry.

By verifying the identities of individuals engaging in cryptocurrency transactions, KYC helps mitigate risks associated with fraud, money laundering, and terrorist financing. As the industry continues to evolve and regulatory frameworks develop, crypto KYC will likely remain a key requirement for individuals and businesses operating in the crypto space.

So, by striking the right balance between security and privacy, we can harness the full potential of cryptocurrencies while safeguarding against illicit activities.

► Sabai Academy — a place where studying blockchain, crypto, fractional ownership, and real estate investments becomes a catalyst for capital growth!

Sabai Academy

Smart Reward System exclusive for academy participants!

Related Articles

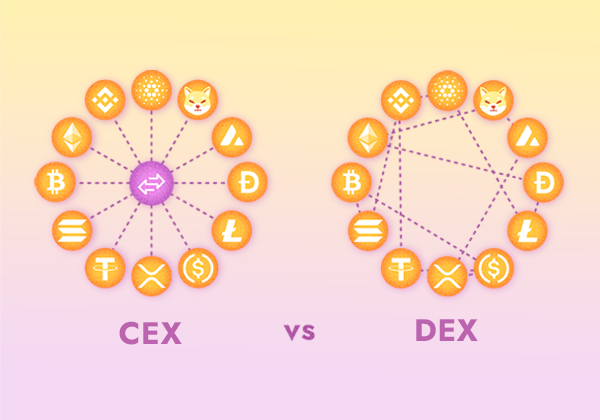

CEX and DEX: How Do Cryptocurrency Exchanges Differ?